14 million people in the UK are living in poverty

Latest News14 million people in the UK are living in poverty

Published: December 11, 2023

Can ethical banking be part of the solution to the persistent challenge of poverty in the UK?

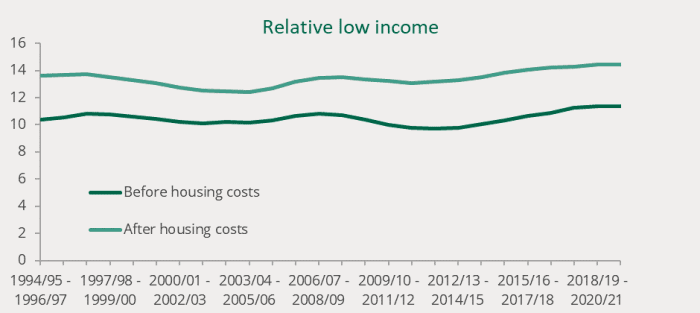

In December 2023, a UK Parliament Research Brief reported that up to 14.4 million people live in poverty in the UK. This is defined as persons with relative low income less than 60% of median UK after housing costs.1 The Resolution Foundation predicted in September 2023 that a further 300,000 people will fall into ‘absolute poverty’. This is defined as 60% of median income against a 2010/2011 benchmark.

Some groups have seen improvements in reducing risk of being in poverty (such as pensioners and working households). However, some of the most vulnerable in society are still at risk of being in ‘persistent poverty’. Children are still more likely to be in persistent poverty. Research by leading think tank Joseph Rowntree Foundation2 found that disabled people, people from black and racially minoritized backgrounds and born outside the UK are more likely to be amongst the 3.8 million people experiencing destitution. Destitution is defined as lacking 2 or more of the following essentials over the past month: shelter, food, heating their home, lighting their home, clothing and basic toiletries.

This persistent challenge in the UK requires a collective effort of government, private sector, finance, third sector and communities to support the most vulnerable in society. At Unity Trust Bank, we believe that integrating principles, practices and values of ethical banking will support organisations to deliver support and solutions to some of the most vulnerable in society.

As an ethical bank, every loan we make supports our ‘double bottom line’. This means that we assess sustainable financial returns alongside social impact. We aim to positively contribute to communities across the UK. By being intentional about ‘creating positive impact’, our lending goes further to ensure that our customers serve those in the society who need it most.

What are the key first steps that finance and investment can learn from ethical banks?

1) Intentionality:

Unity has integrated our commitment to delivering positive impact into every part of our business. Our articles of association state our ‘double bottom line’ of achieving returns and social benefit. This means everything we do considers the social, environmental, economic and community benefits or costs.

2) Impact Measurement and Management:

Unity has set out an impact measurement and management approach. This means every loan is assessed against how it contributes to the social benefit of our ‘double bottom line’. This includes assessing whether lending is going to areas of deprivation where investment is needed. We seek to understand who is accessing the services our customers provide. Additionally, we track how those services solve social challenges like poverty and whether there are risks associated to this.

3) Transparent reporting and achievable commitments:

As an ethical bank, we ‘walk the walk’ but it is equally important to ‘talk the talk’. We support others to adopt best practices for banks and investors. We help to make their investments go further to tackling social challenges. Our annual Impact Report showcases our approaches, what works and what our aims are to keep improving the social, economic and environmental outcomes of our customers.

At Unity, we have been developing our culture, people and approaches to deliver on our ‘double bottom line’ for nearly 40 years. Doing this has enabled us to work with leading charities, social enterprises and social purpose organisations across the UK:

In 2023, Unity provided £8.8m funding to YMCA London City & North. This ensured that thousands of young homeless people could continue to benefit from the charity’s state-of-the-art, 146-bed LandAid House development. The package also included additional working capital. So, young vulnerable adults can continue to be empowered through further housing programmes in the capital.

In Scotland, a £3m loan from Unity, alongside Government grants and security bond funding, helped support New Gorbals Housing Association’s newbuild programme to provide high quality social housing to 276 tenants.

Both the YMCA and New Gorbals Housing Association are examples of organisations delivering direct solutions to poverty and housing in the UK. But, more needs to be done to reduce the number of people in poverty and destitution.

Ethical banking

Ethical banking is only one part of the solution. However, Unity is proof that adopting a ‘double bottom line’ approach to banking can make a significant difference. We’re helping to reduce poverty, improve the lives of local communities and achieve organisational goals.

We’re for banking that works for your community. Learn more about how we’re helping communities across the UK in our Impact Report. Or, to find out more about how we support our customers, head to our Customer Stories.

If you want to speak to someone about how we can support your business, contact us today. Or, you can view our range of Banking Products online.

1 Poverty in the UK: statistics – House of Commons Library (parliament.uk)

2 Destitution in the UK 2023 | JRF