Unity Trust Bank named one of UK’s Top 3 social investors

Latest NewsUnity Trust Bank named one of UK’s Top 3 social investors

Published: October 25, 2022

Delivering social impact has been the very fabric of Unity Trust Bank since its inception in 1984, and new analysis from Big Society Capital reveals it is now one of the top three social investors in the UK.

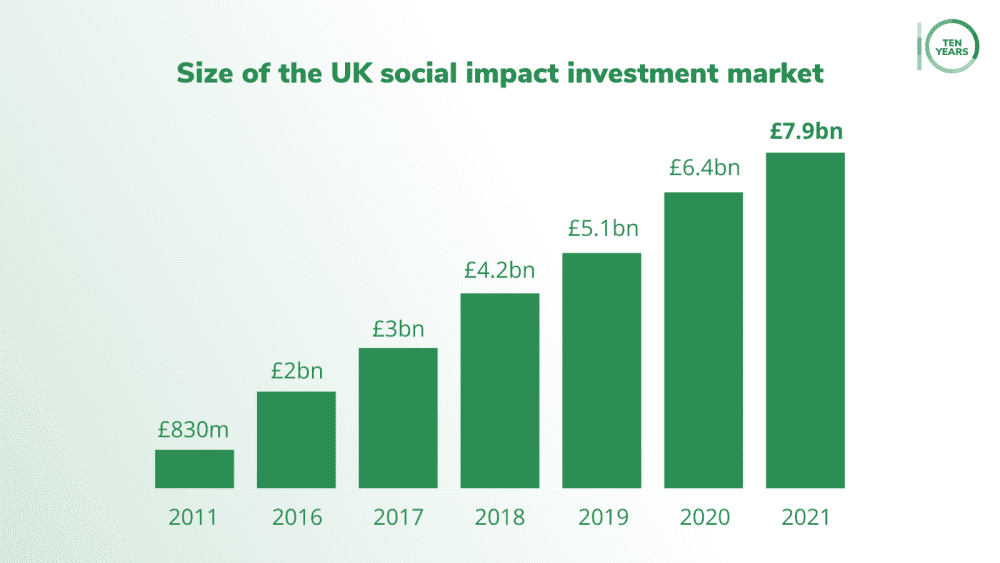

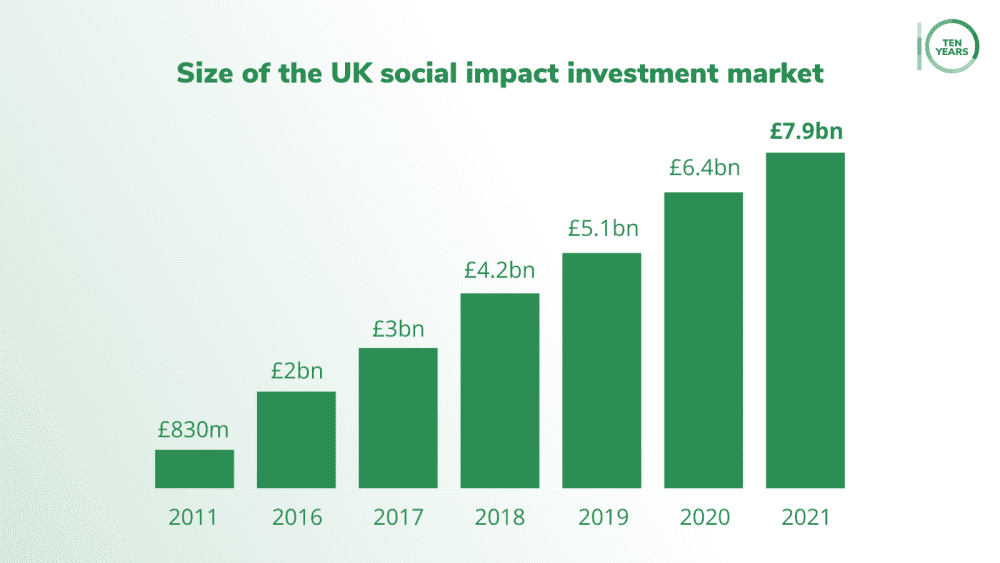

Big Society Capital’s latest ‘market sizing estimate’ shows the social investment market in the UK has grown nearly tenfold in 10 years from £830m to £7.9bn.

In 2021, Unity Trust Bank achieved record levels of lending of £723.5m, making up nearly 10 per cent of the total social investment market.

Words from Unity

Joshua Meek, Head of Impact and Sustainability at Unity Trust Bank, said: “Unity’s vision has always been to create a better society and it is great to see that more and more investors want to facilitate social good, as well getting a good return for their money, and that more capital is reaching socially minded businesses than ever before.

“As a shareholder of ours, we’re excited to see Big Society Capital continue its market sizing data work. It helps us to understand the social economy. This data helps inform what we can do to support socially-conscious organisations at a time of uncertainty.”

One of the key areas Unity Trust Bank has invested in is its network of relationship managers who provide personal, one-to-one support to lending customers and have specialist knowledge in sectors that drive impact across the UK such as education, healthcare and housing.

John Copping is the Relationship Director (North) at Unity Trust Bank. He said: “Both Unity and the social investment market is growing. We need to demonstrate our continued commitment to delivering positive impact in local communities. So, a number of new relationship manager roles have been created.

“We need a deep understanding of the sectors our customers work in. Our relationship managers have a wealth of experience in structuring loans to meet specific needs. This is an integral part of the support we offer.

“Relationship managers take the time to understand our customers’ businesses to help make finance work for them.

“This expertise benefits established operators. They know that their relationship manager is knowledgeable about the day-today workings of their organisation and the challenges they have. It also provides valuable guidance for first-time buyers.”