Published: July 13, 2022

As a socially determined commercial bank, Unity Trust Bank only lends to organisations that share our values and want to create a better society.

As such, we have had a long and proud association with Community Development Finance Institutions (CDFIs).

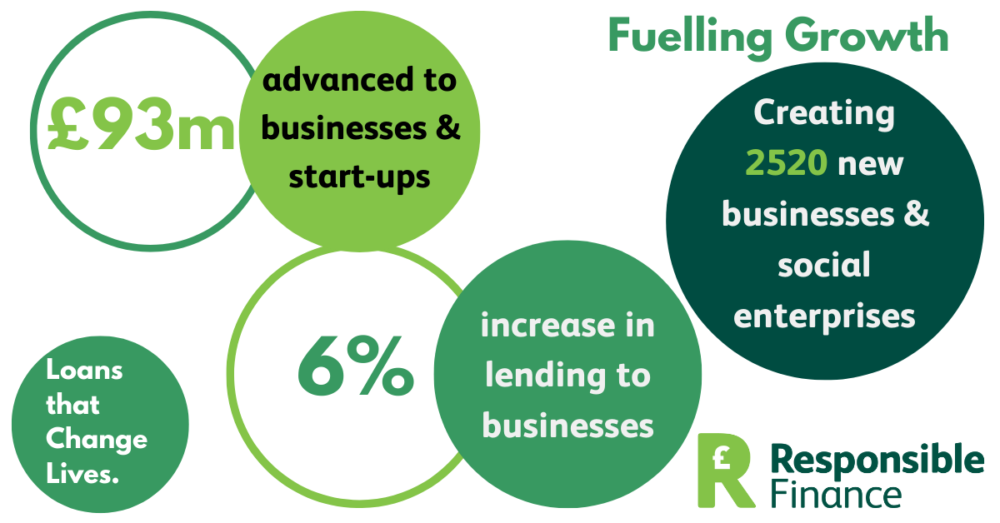

Through CDFIs, we provide accessible and affordable finance to social enterprises and small businesses that struggle to access funding from mainstream banks, helping them to deliver positive economic, social and environmental benefits to local communities.

We are also proud to work with Responsible Finance; an organisation that supports a strong network of CDFIs throughout the UK.

Here, we talk to Responsible Finance’s chief executive, Theodora Hadjimichael, about the impact CDFIs have on the British economy:

CDFIs lend to businesses, social enterprises, community groups and people who cannot get a loan from a bank but are still viable and can afford to repay. There are more than 30 CDFIs that specialise in lending to small businesses and social enterprises. They do this by being located in the communities they serve, speaking to the management team, visiting the business and testing its financial assumptions. By taking a relationship-based approach they are able to help businesses overcome barriers in accessing finance: more than 90% of their customers have previously been declined by another lender, and 90% go on to fully repay their loan.

‘Money makes the world go around’, yet over one million SMEs in the UK cite access to finance as a barrier to growth. There are also inequalities in access to finance for entrepreneurs from an ethnic minority background, women-led businesses and businesses located outside of London. By breaking down barriers and increasing access to those underserved by mainstream finance, CDFIs help ‘make the world go around’, and more specifically give businesses that have been told ‘no’, a chance to grow and bring prosperity to their communities.

CDFIs are unique as lenders because they also provide ‘wraparound’ services such as advice. In 2021 CDFIs provided more than 32,000 hours of advice and support, helping their customers become investment ready.

CDFIs supported 3,260 businesses in 2021 and 9 out of 10 of these were initially turned down by banks – why is it hard for some businesses to get funding from mainstream lenders?

Banks must lend to a lot of customers and have low levels of loan losses to satisfy their regulatory requirements and shareholders’ expectations. To accomplish this, they take an automated lending decision approach. This allows them to assess high volumes of applications quickly, using computer algorithms. To ensure that they lend to businesses that will have the highest likelihood of repaying, they decline those that are viable but may:

These businesses may still be viable but an algorithm can’t make that decision confidently. By talking to the business, CDFIs take a different approach to banks and fintech lenders, and are able to understand the business’ circumstances, how the finance will impact their trajectory and whether they can afford to take on the loan.

We see that barriers in accessing finance exist across sectors. Some sectors tend to have more information ‘opacity’ which makes accessing traditional bank finance harder. Those are hospitality and retail, particularly as their sales and projections have been disrupted by the pandemic. Social enterprises have a non-traditional business model and may receive grant income, so this is another sector that struggles to access mainstream finance.

New and innovative businesses, and businesses launching a new product/service also often struggle, as they lack the track record required by banks. This is an increasing challenge as more businesses seek to adopt innovative solutions to reducing their carbon footprint.

Very small businesses seeking less than £100,000 have few options, as most lenders prefer to fund larger loans which are more profitable.

Women-led and minority-led businesses also face higher decline rates from banks compared with their male/white counterparts. This tends to be because of lack of collateral. Businesses located in areas of higher deprivation also face this challenge, as property values and overall wealth is lower. So, they are less likely to satisfy the banks’ requirements for collateral as risk cover.

CDFIs take a relationship-based approach. This means they have the benefit of ‘kicking the tyres’ to really understand the businesses’ circumstances and their future viability. When assessing a loan application, they first consider ‘soft’ information. This includes the local market and management quality. Them, they look at the hard data that mainstream lenders use, like credit scores and historical trading performance. As lenders with a social purpose, CDFIs also consider the opportunities that the finance will open up. How many jobs will be created or retained locally? Will this project bring more foot traffic to the high street? CDFIs give weight to factors such as strength of management and viability of their projections when making lending decisions.

We know this approach works. 90% of CDFI customers are successful and fully repay, even though they have already been told ‘no’ by another lender. Recent research has shown that when lending to businesses without collateral, CDFIs perform better than banks in terms of loan repayment rates.

CDFIs have supported over 20,000 businesses up and down the country over the past five years. They don’t have restrictions on sector or business size. Instead, they work to break down the barriers in accessing finance. They help their customers create a track record, grow their business and gain confidence. We know that CDFIs make a significant difference for business groups that face greater barriers in accessing finance:

We are incredibly proud of the CDFI sector’s response to the business disruption caused by the Covid-19 pandemic. At the start of the pandemic CDFIs received the number of enquiries they used to get in a month in a single day. CDFIs reacted immediately: the first Coronavirus Business Interruption Loans (CBILS) were made by CDFIs. Overall, they have lent £114 million to date through CBILS and the Recovery Loan Scheme (RLS). This saved 5,850 jobs, protecting the livelihoods of thousands of families.

CDFIs are ‘countercyclical’ lenders, lending more in times of economic uncertainty. Given their relationship-based approach and focus on social impact, they are experienced in assessing risk.

Unity Trust Bank is a long-standing partner of the CDFI sector to help serve the common good.

Between January 2020 and December 2021, Unity Trust Bank supported 11 CDFIs with a total of £22.4m funding. This helped the CDFIs leverage additional finance totalling £13m. Collectively, this money supported 536 small businesses across the UK.

We are thrilled to have a dedicated partner like Unity Trust Bank that is invested in growing the CDFI sector alongside us.

It was an alignment of values that initially brought Unity Trust Bank and Responsible Finance together in partnership. As a socially-minded bank, Unity saw the tremendous social impact that CDFIs created through their lending. And because ultimately business communities and geographic communities are shared communities, Unity saw that CDFIs were creating their future customers. By supporting viable but underserved businesses, CDFIs build their track record and confidence so they can go on to access mainstream finance.

The UN Sustainable Development Goals are ambitious targets set by member states to create a prosperous and sustainable future. National governments and large companies have committed to tracking their progress against each goal, however we cannot get there without working with communities directly.

We talk a lot about barriers in accessing finance, knowing that not getting finance can be a big blocker. On the flip side, it can also be a key enabler: help a restaurant retrofit its building, reducing its carbon emissions; finance a cutting edge manufacturing firm to expand its premises and hire more people; support a social enterprise with advice and low-cost investment to double the number of homeless people they place into permanent housing.

The enabling impact of finance on communities is an important piece of the puzzle to reaching the UN’s 17 goals. We firmly believe that a scaled up CDFI sector, in partnership with stakeholders like Unity, will help us get there.

A big thank you to Responsible Finance and Theodora Hadjimichael for talking with us!